The Best Guide To Refinance Deals

The expense for this may depend upon what state you reside in. Your brand-new lender may want to have an up-to-date assessment done on your residential or commercial property, suggesting that you might need to come up with the fee for the valuer to visit your residential or commercial property. Lastly, as soon as everything is settled, you might need to pay a settlement or legal fee.

Generally you just need to make certain that what you save in the long run, will far surpass what you need to pay upfront to switch. You can use Mozo's house loans change and save calculator to get some concept of what your savings will be. The basic answer is yes - refinancing your home loan might have an impact on your credit rating. best home loan refinance offers.

Rumored Buzz on Best Refinance Deals

When you refinance a loan, your possible new loan provider will perform an official check of your existing credit report. This is known as a tough pull credit inquiry and will be noted on your credit report. The number of tough pull credit inquiries you have noted on your report can impact your overall credit report, so it's best to just obtain a new home loan if you're favorable you wish to change.

The crucial takeaway is to do your research, be selective and to only apply when you're positive the brand-new loan provider and house loan has a lot to use you - best home loan refinance offers. Re-financing your home mortgage is not always the best idea. For beginners, you may currently be on the very best home loan provide around, in which case, it's unneeded.

Repaired rate home mortgage typically come with break costs connected. This means, if you pay off or refinance your loan before the set duration ends, you may get struck with a substantial cost. In this case, you'll require to weigh up the benefits of refinancing against the cost of the break fee to choose the ideal strategy.

Some Of Best Refinance Deals

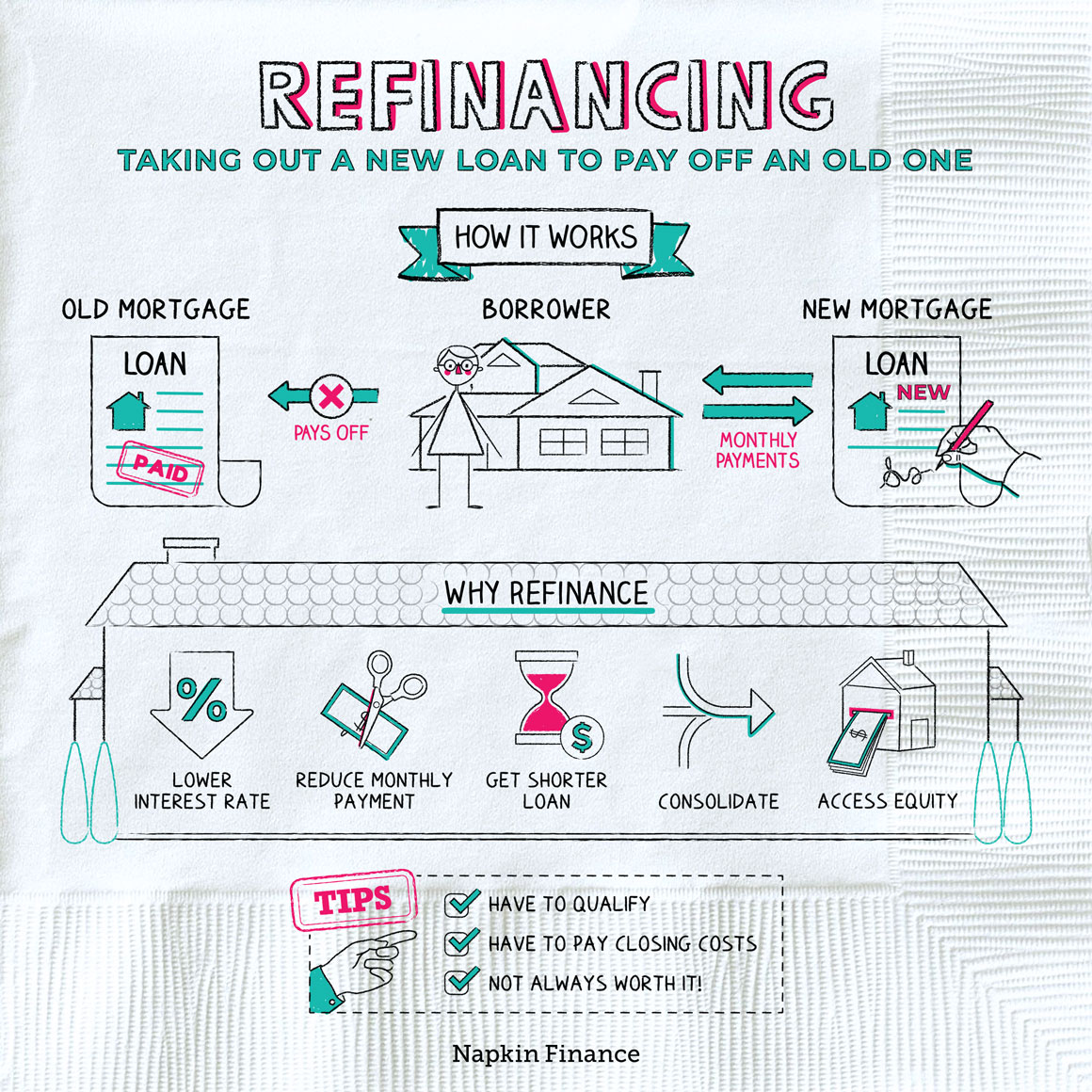

Refinancing your home means changing an existing home loan with a new one. If you discover your existing house loan is no longer appropriate for you click here for more info and your lifestyle, whether it's due to the fact that your repaired loan term is ending or you want to change your rates of interest, you can re-finance to a home mortgage preferable for your scenario.

Refinancing can be rewarding if you have the ability to find a better rate with an alternative lending institution, or if you wish to increase your existing home mortgage to withdraw some equity from your house. So, stop paying commitment taxwhich is the price you pay for being devoted to your lending institution and rather make the time to see if you can get a better deal in the marketplace.

The Reserve Bank of Australia raised the cash rate by 50bps to 2. Interest rates throughout most of the lenders are hovering around 3.

How Refinance Deals can Save You Time, Stress, and Money.

Some debtors prefer the certainty of a repaired home mortgage, which, as the name suggests, describes a static rates of interest during a fixed-rate duration. Some people choose a visit this site right here bet each way: repairing part of their loan for a period, and keeping the staying loan on a variable rate - best home loan refinance offers.

There's no hard best or wrong when it comes to a fixed or variable home loan. Be mindful that if you pick to make changes to your loan contract, you might be stung by fees.

Let them know where you're looking at transferring to, the lower rates available and just how much the fees are compared to what they're offering so you have actually got some bargaining power. How successful this strategy is will depend on a few things. For beginners, the size of your financial obligation, and just how much equity you have in your home.

Everything about Best Home Loan Refinance Offers

One benefit of asking your bank to reduce your rates of interest is that you are spared the trouble of needing to go through the refinancing process: your loan package, with all its bells and whistles stays the same, only your rates of interest modifications. They might likewise desire to charge you a charge for the administrative concern of altering your rate, but many consumers have successfully asked for these costs be waived therefore ought to you.

Your loan term likewise enters into play here. If you don't have actually long delegated settle your mortgage, remember that a brand-new lending institution might put you on a longer loan term, indicating you are connected to debt for longer. Decide whether you feel more comfortable with a larger bank, or a smaller digital lender, and what the benefits and downsides are for each.

Look around and see what's offered on the marketplace. Make certain you speak to a few lenders you have an interest in Full Article changing to, and find out if they are prepared to take on your financial obligation. As soon as you've chosen your favored alternative, you will need to go through an official application procedure.

Indicators on Best Refinance Deals You Need To Know

The loan provider will then prepare the paperwork for you to sign. As soon as you have actually been authorized, your new lender lets your existing loan provider know that you wish to be discharged from the existing loan. Bear in mind that the brand-new loan provider may wish to conduct its own home assessment on your home.

Comments on “The 4-Minute Rule for Mortgage Refinance Deal”